In the original Ichimoku Kinkouhyou book, the third book talks about weekly candle stick, the writer Ichimoku Sanjin had some pattern and experience himself but I like Haguro’s theory more than it. Haguro’s theory is not popular in Chinese even in English, so let me explain it at here.

一目均衡表的原著第三册是【周间篇】,也称作周足均衡表,一目山人在书中总结了自己的心得和型谱。而我更喜欢采用羽黑法。羽黑法在国内不太能够看到资料,所以在这里整理成中英文的说明。

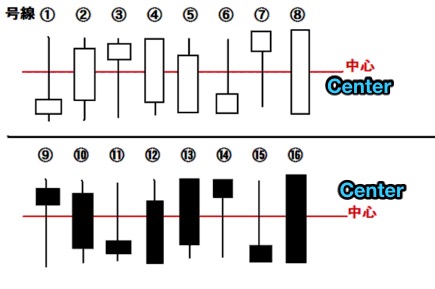

There are sixteen patterns, eight up eight down, the red center line is middle line.

羽黑法总共有16根蜡烛线,八阴八阳相对应。

关于羽黑山人的由来,一直都是个迷。在修行一道,日本北陆黑部的山中是修行人称可以练功开眼的圣地,羽黑山便是那里有名的出羽三山之一。因酒田五法出名的山形县的南面就是鹤岗的羽黑山,所以羽黑法和酒田五法还是渊源很深的.

Mount Haguro is one of the Three Mountains of Dewa where is well-known for holy ground of mountain worship from a long time ago. It is at south of where is same famous Sakata Five Theorys was born. So it is relation with Sakata Five Theorys.

So let’s explain the Haguro theory one by one.

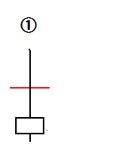

At first, Number One is both shadow and with long up shadow and the body is down of middle line.

第一号线 上影实体阳线,实体在中间线的下方

第一号线 上影实体阳线,实体在中间线的下方

基本战略思想:下周在高位处有小幅回调的可能性很高。小止益目标的逆势单子可做。

下周的开盘价:高开的话,会在一段时间小幅盘整之后,快速冲高,此后可以做空。

跳空低开的话,就意味着会是回调,可以在回调处做多。

Basic trending think: There is higher possible to make sale when the return is happened at high price.

If there is opened at higher jump window next week, it could sell at the return sign after one big and long up line. If the open price is jumped at lower window, it could buy when this return is finished.

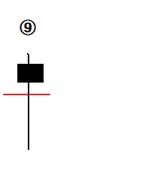

反之,第九号线就是下影线很长,实体在中间线的上方。它的解释就和第一号线截然相反了。

Instead, the ninth pattern is long down shadow and body is upon the middle line. So it seems as opposites to explain mean.

Instead, the ninth pattern is long down shadow and body is upon the middle line. So it seems as opposites to explain mean.

上影线长的场合:做空的线,基本认为是空方优势,下周将是空方势力出动。

上影线较短的场合:基本战略思想就是伺机而动,需要等待。因为多方势力还有余地,所以推荐见机行事。

If the up shadow is long, it will be in sale trending. And if the up shadow is so short, just waiting, do not any trade.